Recent posts

Blog categories

Cannabis Industry Data vs The Alcohol Industry | Green Blazer

The future of cannabis promises an emerging market, and with the industry’s momentous growth thus far we must ask- how big can the cannabis industry grow? Although marijuana is federally considered a Schedule I drug, regulations and laws differ from state to state, making legalization the driving factor for growth. Cannabis is no longer a taboo industry, but rather a fierce competitor for the alcohol industry.

Similar to marijuana, alcohol has withstood the test of time. In 2018 the alcohol industry accumulated $243 billion in revenue of total sales inclusive of supplier, beer, wine, alcohol retail sales, etc., and from 2006- 2018 they had a compound annual growth rate of 4.3%. However, the de-stigmatization and proper education of marijuana consumption is at an all-time high. Millennials, individuals born from 1981-1996, account for a fourth of the total U.S population and are the prevailing target market for cannabis. Unlike previous generations, Millennials demand constant media production, connectivity, and exceptionally authentic experiences, and the cannabis industry is adhering to its consumers. Rather than drinking largely produced domestic beers, Millennials opt for craft beer or wine. Still yet, a ten-year study by the University of Connecticut and Georgia State University found wine and beer purchases decreased 15% in states with legalized marijuana. An annual national survey of 50,000 college students found in 2016 4.3% of students drank alcohol daily while only 2.2% attested to drinking alcohol daily in 2017. Millennials legitimately watched marijuana become legal as young adults; it’s no wonder why they prefer to stay in and smoke rather than go out and spend money on expensive drinks at a bar - considering they just spent thousands of dollars on education for jobs with salaries that do not reflect that. Spending upwards of six hours a day on social media and proven to have significantly less wealth and savings, Millennials are merely trying to stay connected on a budget, and marijuana is cost efficient and socially shareable.

According to Arcview Market Research and BDS Analytics, $6.9 billion was spent globally on legal cannabis in 2016, $9.5 billion in 2017, $12.2 billion in 2018, and sales were projected to jump 38% reaching 16.9 billion in 2019. Estimating by 2022 legal revenue will reach $31.3 billion, meaning in a five- year span the compound annual growth rate is 26.7%. To break this down:

Cannabis = 26.7% growth in 5 years vs. Alcohol = 4.3% growth in 12 years.

Beyond Arcview’s estimate of the cannabis industry reaching $31.3 billion by 2022 there are two other notable trajectories worth mentioning. Wall Street Investment bank Jefferies analyst Owen Bennet estimates that the $17 billion of revenue in 2019 will reach $50 billion by 2029. This research suggests the medical marijuana industry will account for $19 billion whereas the remaining $31 billion in global revenue comes from illicit markets. Cowen Group analyst Vivien Azer projects $75 billion in global sales by 2030, assuming the current global cannabis industry is already worth $50 billion due to the black market.

Let's talk about the black market; yes, the black market is illegal, but quite frankly cannabis is not legal everywhere and the black market is the only outlet for the majority of consumers. For that reason it is extremely important to recognize the difference between illicit markets and legal distribution. Black market growers and sellers do not have to wait from licenses or sales permits, they cultivate where they can. They also don’t pay state income tax or federal income tax. The legalization of cannabis was meant to -collect billions of dollars in tax revenue to fund local governments- create a marketplace where consumers were educated on the safe and high-quality products they were purchasing. No surprise here though, tax is expensive, and so is buying from a dispensary where products can be marked up 50% in comparison to street prices. Cost efficiency and availability is why the black market continues to thrive. Unfortunately for the legal cannabis industry it can only continue to grow and outweigh illicit channels if consumers choose the legal route.

There is no easy answer to solve the debate of whether weed is better than alcohol because people’s responses to both substances vary greatly. However, research shows weed typically involves fewer risks than alcohol. For example, less long-term health effects such as liver disease, pancreatitis, heart damage, ulcers, infertility, and central nervous system damage- just to name a few. The CDC reports nearly 88,000 alcohol related deaths per year; binge drinking accounted for half of the death. In comparison experts claim the chance of dying from marijuana consumption is extremely low. To be fair marijuana does have side effects which include, increased hunger, impaired perception of time, drowsiness, relaxation, pain relief, giddiness, and possibly the worst of all dry mouth. While there are numerous studies on the damaging effects of alcohol there have not been enough conducted on marijuana to deliver viable evidence that one substance is better than the other. Millennials have made their decision, and marijuana wins this round, but in order for the cannabis industry to surpass the alcohol industry it is up to two things: legalization and consumer tradeoff.

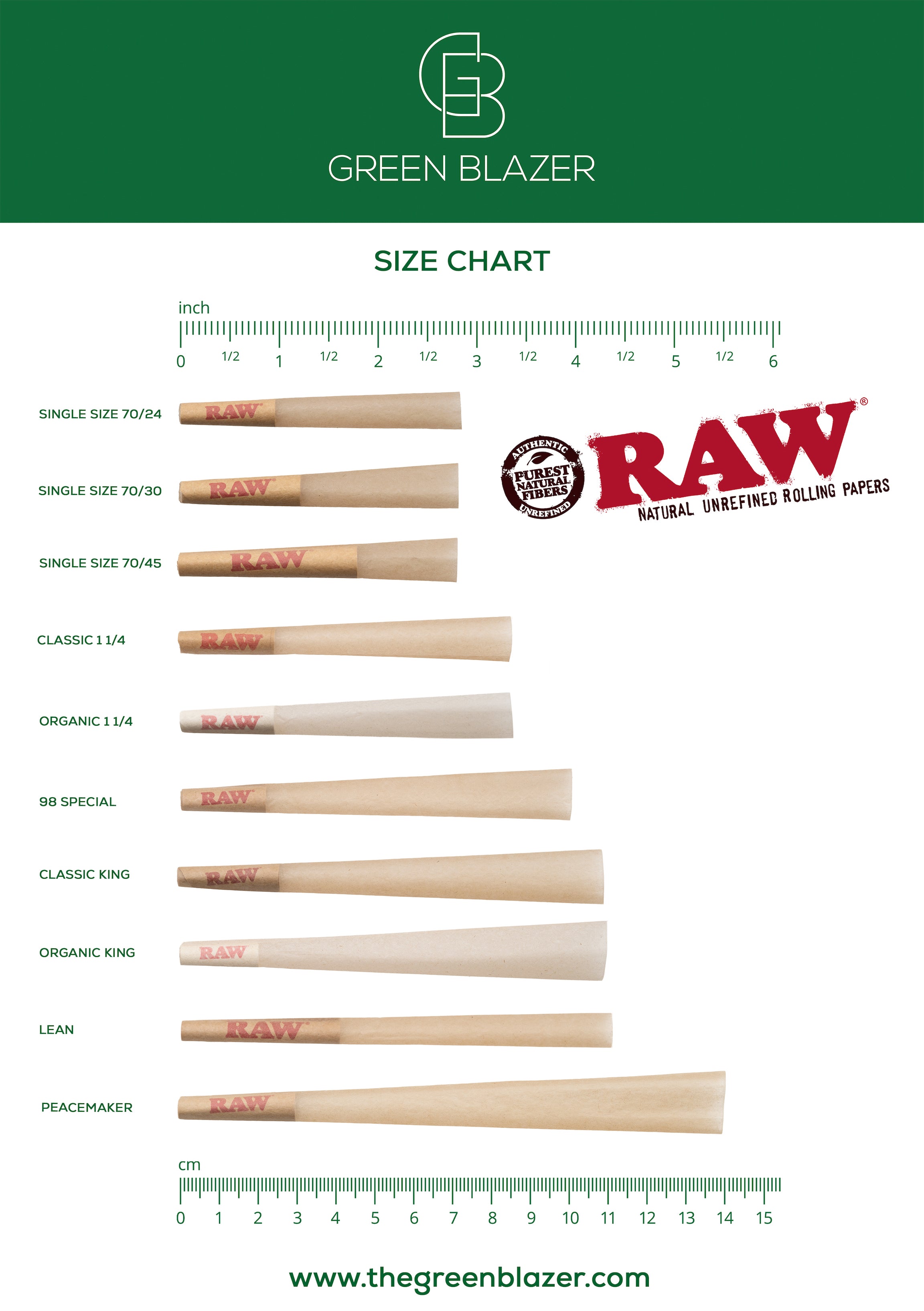

For more information about The Green Blazer and our raw pre-rolled cones, contact us today!